Gst Goods And Service Tax Rate

The current gst rate in singapore is 7.

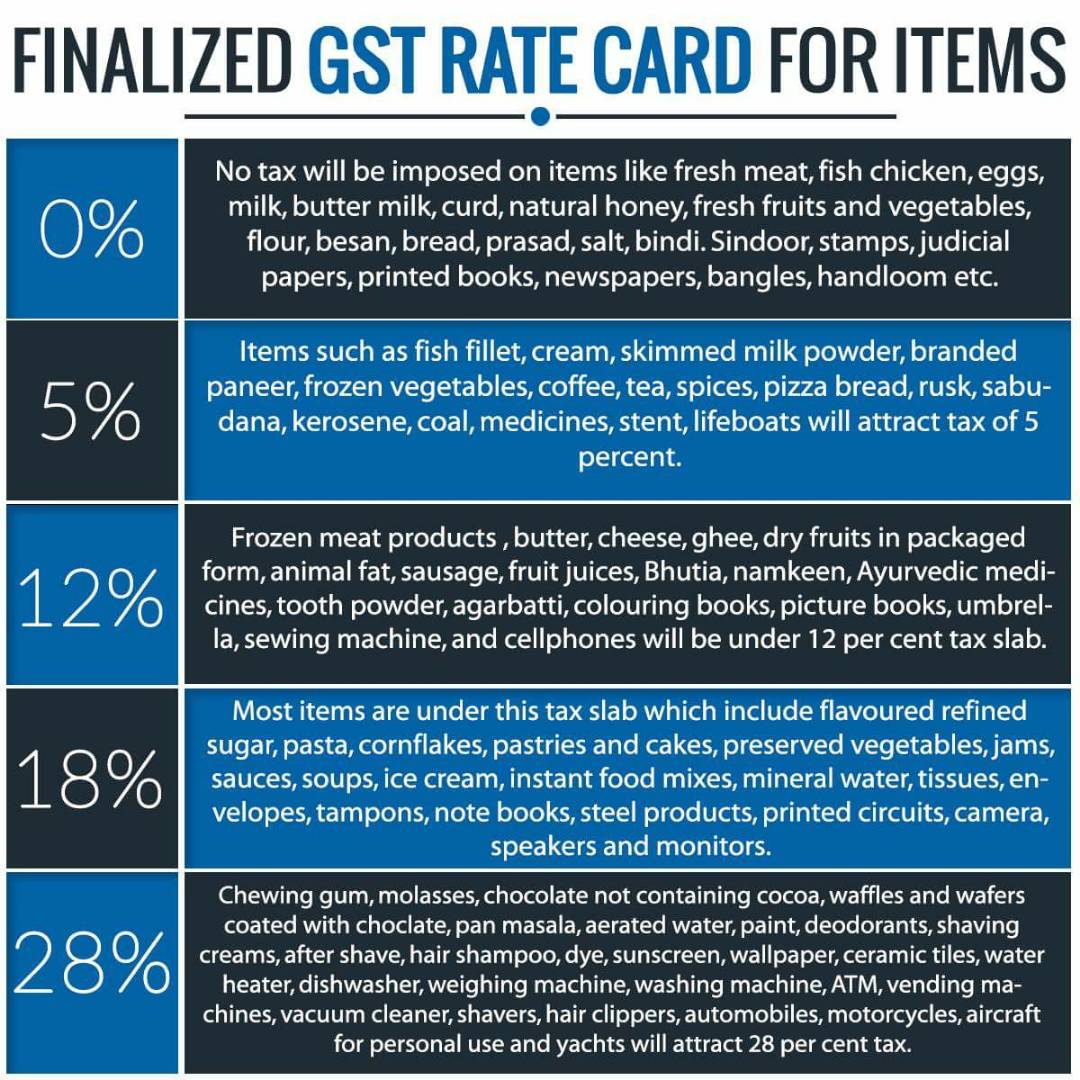

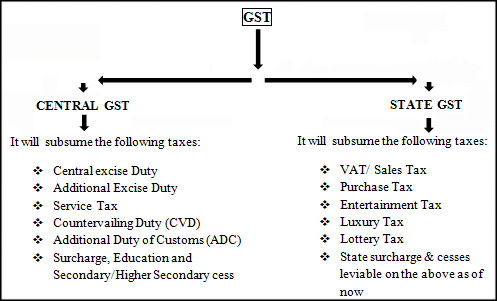

Gst goods and service tax rate. Find latest gst rates for all goods and services in 0 5 12 28 slabs. One must note that there are basically three types of gst. In india nearly all goods and services under the purview of gst have been divided into four gst rates 5 12 18 and 28. The gst council has fitted over 1300 goods and 500 services under four tax slabs of 5 12 18 and 28 under gst.

Gst registered businesses are required to charge and account for gst at 7 on all sales of goods and services in singapore unless the sale can be zero rated or exempted under the gst law. Check revised gst rates list 2020 21 updated gst tax rates slab gst rates. As per the central goods and services tax act 2016 it is the centralized part of gst that includes most of the. What are the gst slab rates.

Last updated at sept. 2 2020 by teachoo. Goods and services tax or gst is a broad based consumption tax levied on the import of goods collected by singapore customs as well as nearly all supplies of goods and services in singapore. Gst tax rates on goods and services.

Cgst central goods and services tax is applicable on the goods and services which are considered to be standard and tax rates can be amended periodically all the revenue collected is allocated to the central government. In other countries gst is known as the value added tax or vat. The gst council revises inclusions under these rates from time to time in order to ensure efficient pricing of different categories of products. Gst is imposed at a rate of 10 of the value of the goods and services sold or goods imported.

15 12 in 2009 9 in 2010 17 7 for certain goods and. Gst is a tax levied for the consumption of goods and services. Tax rate in gst on goods and services. The gst council of members has held several rounds of meetings to revise gst rates the latest gst rates show a reduction of 6 to 18 in gst rates for various commodities across most categories.

Three steps to understanding gst step 1 a gst registered business eg. 5 10 service sales tax. There has been much debate on gst tax rates recently amongst the trading community and the gst council. A retailer purchasing goods and services for the business will pay the supplier of those goods gst of 10 if the supplier is registered for gst.